Close

Back

Driving change

together.

Responsibly.

Driving change

together. Responsibly.

Our purpose runs

through everything

we do

Driving change

together. Responsibly.

Our purpose runs

through everything

we do

Core to our business strategy, we deliver

our purpose via a clear focus on our three

strategic priorities, alongside our commitment

to doing business responsibly.

We are committed to being a responsible

business; driven by our resolve to do the right

thing, measure and report transparently and

always act ethically, and with integrity.

Our diverse and inclusive culture simply

wouldn’t be possible without our steadfast

commitment to our purpose. Pulling together,

we all work towards the same goal.

01

It actively guides

our strategy

02

It enables us to

make a difference

03

It drives our

values-led culture

We are the UK’s largest digital automotive

marketplace. We are embarking on a journey

where used and new car buyers can not only

complete their research on Auto Trader,

but complete more of the transaction too.

Growing our marketplace, delivering better

online buying and selling experiences, and

building stronger partnerships are all key to

this and form the focus of the people that

make it happen — I'm extremely proud of

our amazing teams that are shaping the future

of the automotive industry, day in, day out."

Retail Price Index

Published monthly, our RPI provides an overview of the latest retail price data

from across the whole UK market.

Our team of data scientists monitor

circa 800,000 vehicles each day, including 116,000 vehicle updates and an average of 39,000 vehicles added or removed from Auto Trader.

We are committed to being a responsible

business and our purpose is driven by our

resolve to do the right thing, measure and

report transparently and always act ethically

and with integrity.

As the UK's largest automotive marketplace,

we have a responsibility to create a more

accessible, equitable and more sustainable

future — for everybody.

Annual report

Download

RNS & inside information

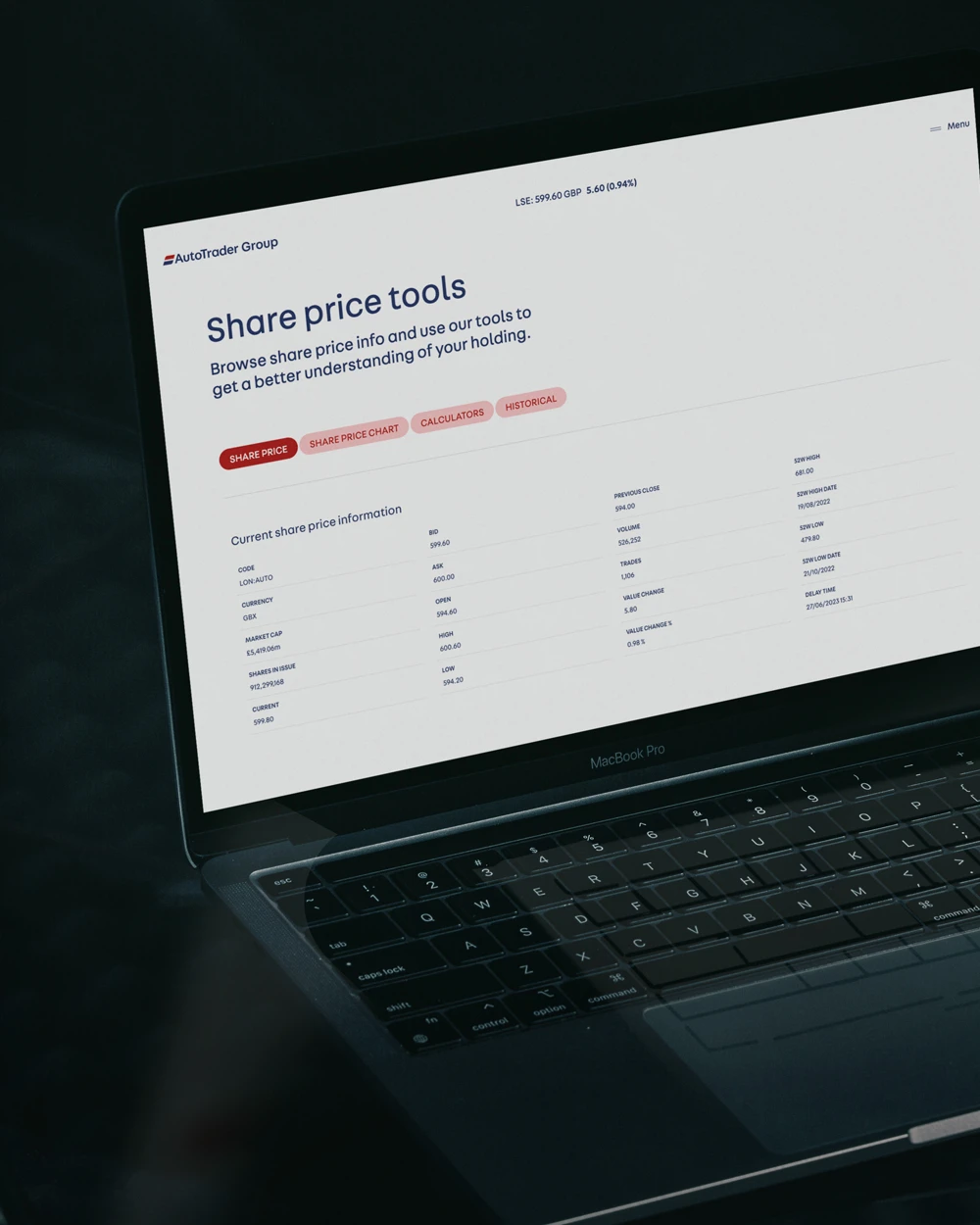

View allShare price tools

Find out more

01

Annual report

02

RNS & inside information

03

Share price tools

As leaders in our market, we are constantly innovating and looking to do things differently

Our trusted brand has been built over the last 45

years through advancements in our technology and

products, coupled with a highly skilled digital team.

By leveraging our leading market position and

technology platform we have a unique network effect

that allows us to create value for our stakeholders.

We are continually adapting our onsite experience

to meet the changing needs of both our consumers

and customers.

With an unrivalled data set and more

than four decades of experience, we

are the industry’s thought leader when

it comes to today’s — and tomorrow’s —

UK automotive marketplace

Sign up to our email alerts service:

Join our news & views mailing list

or submit media-related enquiries: