Close

Back

NEW AND USED CAR MARKET TO GROW, BUT ACQUIRING NEW-TO-BRAND CUSTOMERS CRITICAL FOR 2025 NEW CAR SUCCESS

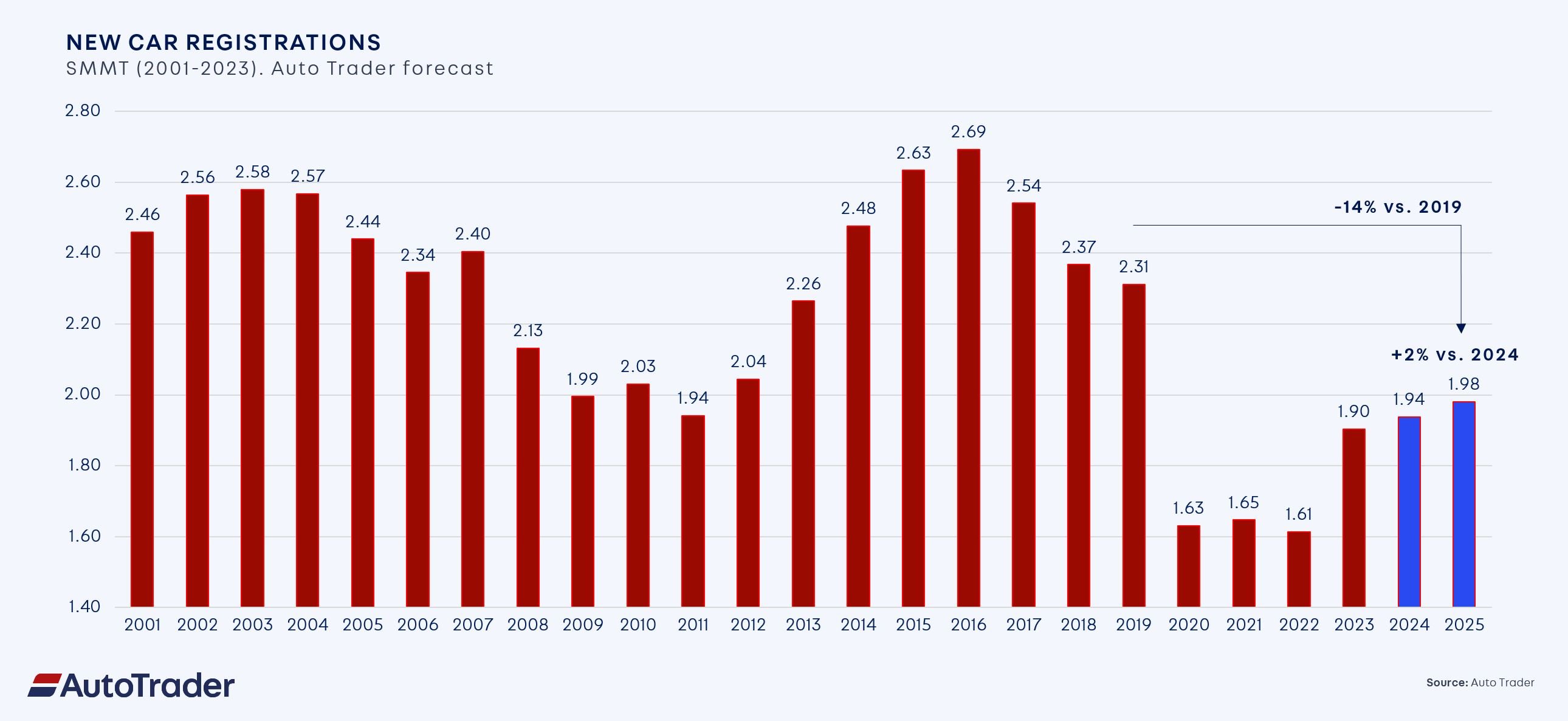

According to Auto Trader analysis, the new car market is predicted to remain just under the 2 million car level next year, rising 2% in 2025 from an estimated (e.) 1.94 million registrations to circa 1.98 million. However, with manufacturers and retailers facing a challenging combination of stricter regulatory targets, uncertain brand loyalty, and more marques and models than ever vying for a share of a still constrained market, a brand ‘conquest’ led approach of attracting new customers will be critical for success.

Whilst it will mark the fourth consecutive year of growth, the new car market will be 14% below the 2.31m new car registrations recorded in pre-pandemic 2019. Since the atypical years of 2021 and 2022, new car supply has returned, retail demand for new electric vehicles (EV) has eased, and Zero Emission Vehicle (ZEV) targets have been introduced. As a result, 2024 saw a return to ‘push’ dynamics, albeit to a lesser extent than pre-pandemic levels, with discounts rising to 9% in October, up from 7.4% 12 months earlier.

Whilst this activity, along with increased marketing investment, has helped stimulate consumer interest (visits to the Auto Trader new car platform rose 20% YoY in October), EV market share in 2024 is predicted to reach just 18%, short of the 22% ZEV requirement. And with an e. 740,000 registrations, private new car sales are expected to be down -27% this year vs 2019’s circa 1 million, making it the lowest level in over two decades.

As well as a smaller market, due in part to the recent increase in new car prices (£31,000 to £43,020 since 2019[ii]), established players will face tougher competition, with an additional 17 automotive brands[iii] (and 81 models) vying for supremacy in 2025 compared to 2019. It will require them to rebuild brand equity as consumers remain less familiar with the growing array of new electric models.

With increased ZEV targets (28%) and car buyers increasingly open to new options (new car buyers research an average of 17 brands[iv]), manufacturers and retailers will need to focus on more than just converting existing petrol or diesel customers into their own electric models. As the new EV market share rises to an e.23% in 2025, and each manufacturer aims at their own 28% ZEV objective, targeted data-driven marketing will be crucial, getting their brand, their deals, and their stock in front of more buyers than their competitors.

‘Extremely resilient’ used car market set to rise

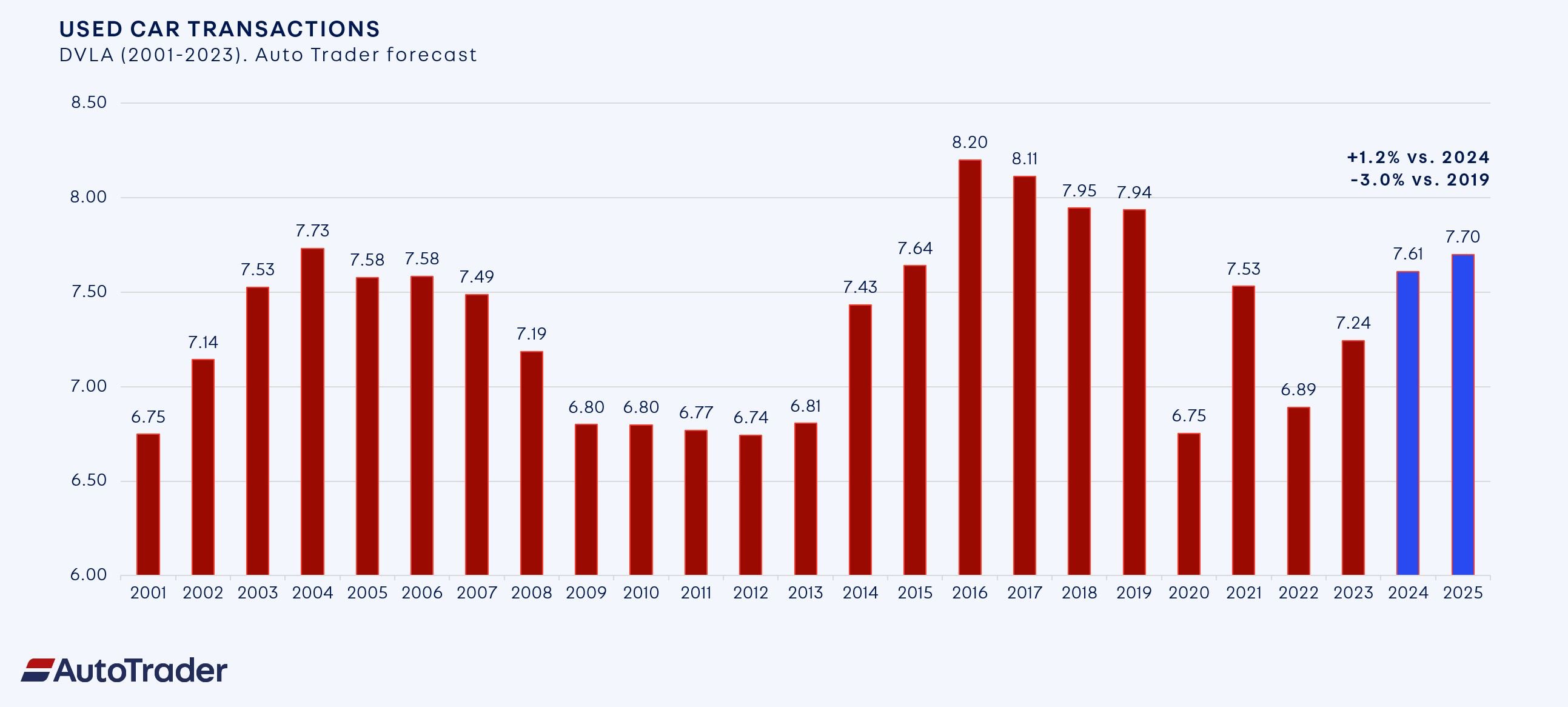

Despite the political instability of a general election and a challenging economic backdrop, used car demand remained extremely resilient this year, as reflected in the 970.6m[v] visits to Auto Trader over the last 12 months; 74m more than the same period last year. With such strong fundamentals, and an improving economic outlook, Auto Trader expects the used car market to maintain the strong growth momentum of the last two years and rise from an e. 7.61m sales this year to e. 7.70m. Although at 1% YoY, it’s behind the circa 5% annual increase recorded since 2022, it means the market will be within just 3% of pre-pandemic volumes and stock should continue to turn over at a similarly fast pace as seen in 2024.

It’s been another landmark year for automotive retailing, one that’s included a range of challenges, not least the introduction of ZEV targets, constrained supply, changing finance rules, and the budget, but also exceptionally strong used car demand, record levels of engagement on our platform, rapid speed of sale, and the stabilising of retail prices. And with the more attractively priced and available stock in recent months helping to fuel new car interest, the overall retail market is entering 2025 on a strong footing.

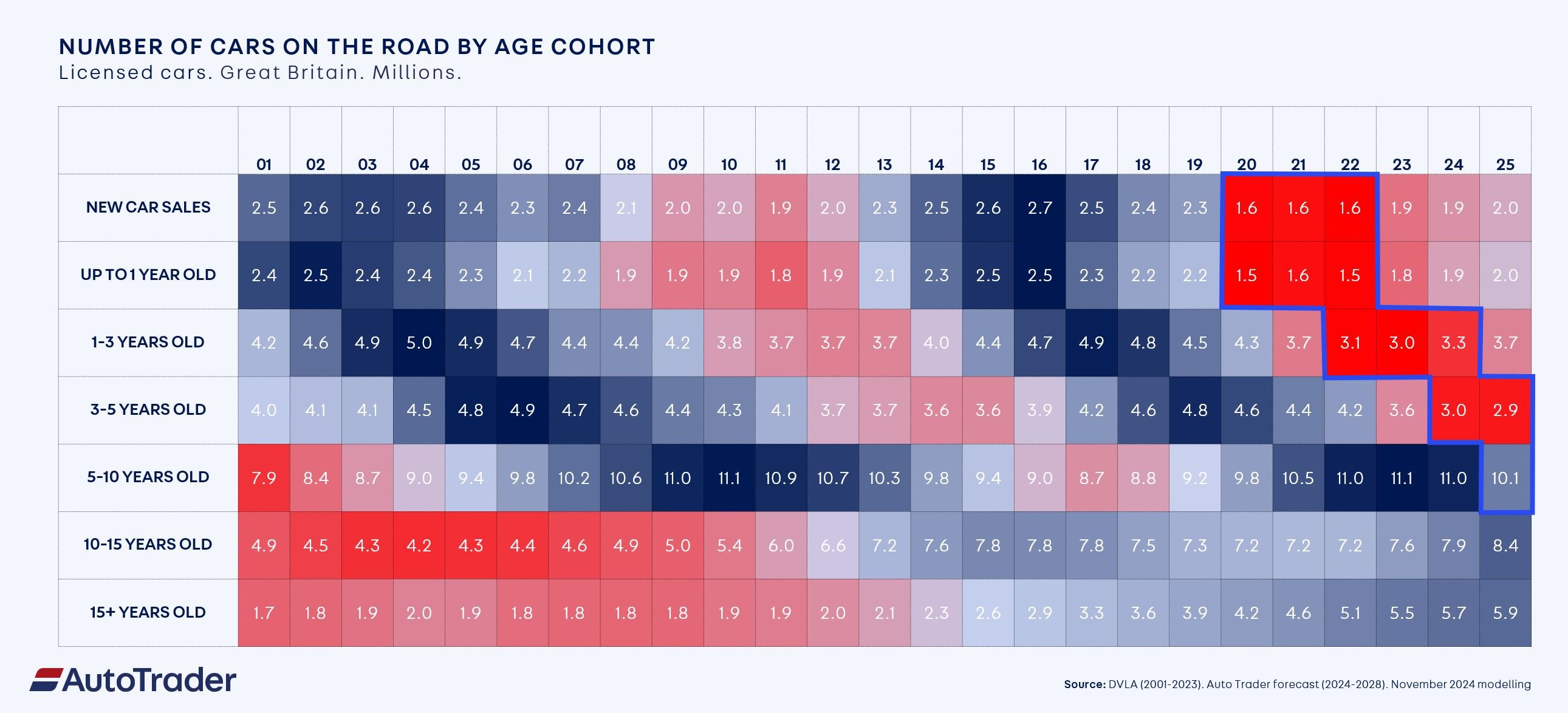

The complexity and sourcing challenges of the last three years will remain as the full impact of the 3m new cars not sold during the pandemic continues to flow through the parc, shifting from 1-3-year-old cars to the 3-5-year-old segment of the market, and begin to impact 5-10. Indeed, in 2019 there were circa 4.8m 3-5-year-old cars in the parc. By the end of this year, it falls -37% to just 3m and by the end of next, 2.9m, making it the lowest level on record[vi].

Parc passes peak petrol

Shifts in fuel type supply will create further sourcing challenges next year. According to Auto Trader’s analysis, 2024 will mark a peak in the volume of petrol cars in the UK car parc, with its share beginning to soften from 2025 as electric supply continues to accelerate. Indeed, the number of EVs in the parc will reach 1.66m next year, which is a 33% increase on 2024 (1.25m), and equates to a 5% share. On Auto Trader, EV stock rose 32% YoY in October, whilst petrol numbers fell -7%, marking the seventh consecutive month of decline. By 2027, there’ll be nearly a million fewer petrol cars in the parc[vii], and with demand unlikely to wane significantly anytime soon, Auto Trader expects prices to rise, and more competition for stock. Having a used EV strategy in place will be even more vital.

Plummer continued: “2025 is set for growth, but this year’s complexities will remain, and in some cases, tighten, particularly within the new car market, where a rapidly growing array of brands will be competing for the attention of an increasingly fickle new EV buyer. Brands and retailers alike cannot afford to standstill and will need to adopt a conquest mindset next year, as well as focusing on what they can excel at – delivering great product, a great experience, and a great performance, all of which we’ll continue to support through our technology, data and our investments.”

AI to power the market in 2025

With these challenges and complexities, driving performance, improved efficiencies, and cost savings will be key in 2025. To support its industry partners, Auto Trader will continue to invest in new technologies and solutions to help alleviate retailer pain points and drive consumer engagement and conversion.

In the new year, Auto Trader will be launching the second wave of artificial intelligence powered Co-Driver features, AI Generated Descriptions, and Key Selling Points. Along with Smart Image Management, the first of a multi-year pipeline of AI powered features launched earlier this month, they’ll use the same powerful combination of AI driven Auto Trader Intelligence, underpinned by over 80 million monthly cross platform visits and circa 619 million combined search minutes every month, as well as around 1.6 million daily vehicle observations. It also includes comprehensive VIN specification details sourced directly from leading manufacturers.

Developed by Auto Trader’s in-house team of over 400 data scientists and engineers, Co-Driver represents the scale of its data and technology capabilities and marks the pinnacle of more than a decade of investment in AI.

These initial solutions, as well as all future Co-Driver releases, will not only alleviate many of the challenges facing Auto Trader’s partners today, but also help them to deliver retailing excellence. To join beta testing for AI Generated Descriptions, retailers are encouraged to contact their Account Manager.

Follow us on our social channels to keep up with the latest news, insights and company developments.

If you would like to be added to our News & views mailing list, or have any media-related enquiries, please contact our press team:

Looking to join the team?

Looking to make a sale?

Looking to make a purchase?

Sign up to our email alerts service:

Join our news & views mailing list

or submit media-related enquiries: