Close

Back

Retail Price Index | November 2021

Used car prices record five years' worth of growth in just six months

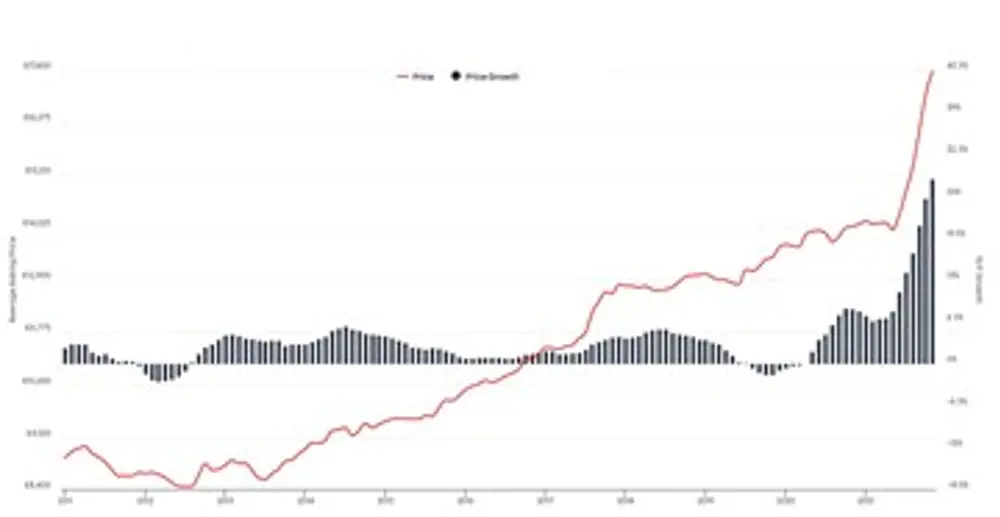

According to the latest results from the Auto Trader Retail Price Index, which is based on daily pricing analysis of circa 900,000 vehicles, the recent record growth in average used car prices shows no sign of significant easing. In fact, with an average price of £17,366, November marked the 20th consecutive month of growth, with prices increasing a record 28.6% on a year-on-year and like-for-like basis.

So huge is the recent acceleration in used car prices, the market has recorded nearly five years’ worth of growth in just six months, with the average sticker price increasing circa £3,400 since May 2021 (£13,973). Based on the used car price trajectory between 2017 – May 2021, the market would not expect to see the current average price of a used car (£17,366) until April 2026.

Further highlighting just how strong today’s used car market is, more than a quarter (25.8%) of the ‘nearly new’ cars available (those aged up to 12 months) are currently more expensive than their brand-new equivalents. This is up from the previous all-time high of 22.8% recorded in October, and, remarkably, over six times as many than in January 2021 (4%).

Although the level of price growth is exceptional, it’s being fuelled by simple economics – very high levels of demand, coupled with low levels of supply. The increased consumer demand is highlighted in the recent surge in traffic to the Auto Trader marketplace; there were 56.9 million cross platform visits in November, which is a 23% increase on November 2019. Similarly, the amount of time consumers spent researching their next car on Auto Trader also increased, up 12% (a total of 8.6 million hours) over the same period.

In contrast to this huge growth, the well-publicised constraints in both new and used car supply is still being keenly felt in the market. According to the Auto Trader Market Insight tool, which is available for all retailers, supply was down circa -9% last month when compared to November 2019. Combined, these dynamics are creating very strong market conditions, as highlighted by Auto Trader’s Market Health metric, which is up 19.9% on November 2019.

Another outcome of these unique supply and demand dynamics is a reduction in the average number of days a used car takes to sell. In November, used cars were selling 13% faster than they were two years ago (28 days vs. 32 in November 2019).

Looking at pricing on a more granular week-on-week (WoW) basis, growth has softened, slowing from an average circa 1% WoW increase in September 2021, to slightly above flat (0.1%) during the final week of November. However, contrary to some commentators who have speculated this is evidence of an end to the recent record price growth, based on the hundreds of thousands of price movements Auto Trader tracks across the market, this WoW easing is in line with seasonal trends, following very similar trajectories to both 2019 and 2020.

Richard Walker, Auto Trader’s Director of Data and Insights, commented:

There’s been some suggestion that the period of huge price growth is coming to an end, or we’re finally about to see the ‘bubble burst’. Beyond what we’d expect for this time of year however, we’re seeing absolutely no evidence of that being the case. Although week-on-week price movements may continue to soften over the coming weeks, average prices remain nearly 30% above what they were last year. Looking further ahead, the new and used car supply constraints will last for much of next year, and with the economy set to grow, we can expect to see the very robust levels of consumer demand continue. Simple economics therefore point to a continuation of very strong price growth well into 2022.

ICE demand heats up, as appetite for electric surges

In terms of specific fuel types, due to the imbalance of supply and demand in the market, both used petrol and diesel vehicles are recording exceptional YoY price growth, up 29.5% (£16,189) and 29.4% (£17,279) respectively. Demand for petrol increased 11.3% YoY, whilst supply fell -7.4%. Demand for diesel increased a slightly more conservative 6.0%, but the drop in supply was twice as great, falling -14.4% in November.

Prices for both volume[i] and premium[ii] electric vehicles (EVs) saw significant month-on-month (MoM) increases. Last month volume brand EVs increased 27.8% YoY (£25,732), up from 20.7% growth in October, whilst premium brand EVs grew at a rate of 10.1% (£48,564), up from 3.8% the prior month. YoY demand saw downward MoM movements for both, but still remain exceptionally high with volume EV brands at 75% YoY (down from 130% YoY in October) and premium EV brands at 70.7% YoY (down from 99.4% YoY).

November make and model price movements (all fuel-types)

|

Top 10 price growth (all fuel types)| November 2021 |

Top 10 price contraction (all fuel types) | November 2021

[i] Volume EV brands categorised as: Ford, Volkswagen, Vauxhall, Peugeot, Nissan, Citroen, Kia, Hyundai, MG, Renault, SEAT, SKODA, Honda, Toyota, Fiat, Suzuki, Mazda, Mitsubishi, Smart, Dacia, Jeep, Subaru

[ii] Premium EV brands categorised as: Audi, BMW, Mercedes-Benz, Land Rover, Jaguar, Tesla, Volvo, MINI, DS AUTOMOBILES, Lexus, Abarth, Alfa Romeo

Follow us on our social channels to keep up with the latest news, insights and company developments.

If you would like to be added to our News & views mailing list, or have any media-related enquiries, please contact our press team:

Sign up to our email alerts service:

Join our news & views mailing list

or submit media-related enquiries: